|

|

Post by bsutrack on Jul 3, 2022 10:22:29 GMT -6

|

|

|

|

Post by bsutrack on Jul 9, 2022 20:28:27 GMT -6

This week the Energy Information Administration (EIA) reported that on July 1st the Strategic Petroleum Reserve (SPR) has been drawn down to 492 million barrels of oil. This is the lowest level since 1986. Approximately another 120 million barrels will be taken out between now and the mid-term elections in November. At that time, the Democratic Emergency will be over and the releases will cease. If you think all this oil is going to the US market, you would be wrong. Doing June, over 5 million barrels were sent to such places as the Europe, India and China. On Thursday, the Washington Free Beacon published new details about the Chinese oil shipments from the U.S. emergency reserves that Biden promised were tapped to “ease the pain that families are feeling” in the United States from high energy prices. “The Biden administration sold roughly one million barrels from the SPR to a Chinese state-controlled gas giant, a move the Energy Department said would ‘support American consumers’ and combat ‘Putin’s price hike,'” the Beacon’s Collin Anderson reported. “Biden’s Energy Department in April announced the sale of 950,000 Strategic Petroleum Reserve barrels to Unipec, the trading arm of the China Petrochemical Corporation. That company, which is commonly known as Sinopec, is wholly owned by the Chinese government.” Sinopec is also tied to Hunter Biden, whose private equity firm, BHR Partners, bought a $1.7 billion stake in the company seven years ago.Hunter Biden’s lawyer told the New York Times in November that the president’s son, “no longer holds any interest, directly or indirectly, in either BHR or Skaneateles.” According to the Washington Examiner, however, Hunter Biden remained listed as a part-owner of the firm as late as March.thefederalist.com/2022/07/08/biden-sold-oil-from-emergency-reserves-to-chinese-gas-giant-tied-to-his-scandal-plagued-son/ |

|

|

|

Post by coastalcard on Jul 10, 2022 6:42:11 GMT -6

Jerry Maguire

|

|

|

|

Post by bsutrack on Jul 10, 2022 12:15:05 GMT -6

|

|

|

|

Post by bsutrack on Jul 10, 2022 14:35:06 GMT -6

Only in this case instead of "show me the money", it's follow the money. |

|

|

|

Post by bsutrack on Jul 12, 2022 21:55:54 GMT -6

|

|

|

|

Post by 00hmh on Jul 22, 2022 7:39:40 GMT -6

Texas, the most oil friendly state, is a textbook case. Regulators there have ignored the problems with their grid and the need for their state to be linked efficiently, and now can only just sit and watch the rolling blackouts. But the real problem is also just needing to plan for greater energy use efficiency, greater efficiency in moving energy on the grid, not just on the supply side in generation. Texas has a significant number of Lefty Loons in Austin who have placed way too much of their capital investment into windmills instead of constructing more fossil fuel generating capacity. The Texas electrical grid is unstable because of the wild swings you get in how much wind power is generated on any particular day. Most really hot and cold days are associated with high pressure centers which result in days of low wind speeds just when you need the dang windmills the most. Not entirely clear. Good arguments on other side about the problems. Diversified energy looks like a good idea. www.washingtonpost.com/opinions/2022/07/21/heat-energy-crisis-would-be-worse-without-solar/Cold weather caused problems in the winter with OIL power...the article has a point. Without wind power Texas would be hurting this summer. |

|

|

|

Post by chirpchirpcards on Jul 23, 2022 7:29:40 GMT -6

So what is causing the sudden fall in gas prices? Is there more oil available now or is there some other factor I don't know about driving the prices back down?

|

|

|

|

Post by 00hmh on Jul 23, 2022 8:51:06 GMT -6

So what is causing the sudden fall in gas prices? Is there more oil available now or is there some other factor I don't know about driving the prices back down? It still hurts, though.

bsutrack may have an industry viewpoint to explain it but it sure looks like Econ 100. This is a market where prices are often volatile. Supply and demand in normal times often vary, there is a lot of local market factors, including refining changing from heating to gasoline in the Spring, and although we are less dependent on world supply than many countries, at the margin changes in the world prices factor in fairly quickly.

We had lower prices a year or two ago as pandemic travel was down. We entered summer with expectation of increased travel but at the same time things were literally blowing up in the world market. Travel plans were anticipated, but prices went up dramatically in part due to uncertainty about the unanticipated Russian oil supply, uncertainty which has to some degree been reduced as markets adjusted.

On the demand side, the higher price at the pump no doubt altered peoples plans for driving reducing demand. So some of this drop is not exactly an anomaly

In this case the world supply has adjusted some (When world oil prices go down it takes 1 week or two to see US gas prices change.) Domestic production is up a bit, and the release of US reserves has some influence. The higher price no doubt motivated some additional production, so every little factor contributed.

If we don't get some new shock, things probably become a new normal, higher equilibrium than a year ago when pandemic travel was more limited.

|

|

|

|

Post by bsutrack on Jul 23, 2022 12:42:03 GMT -6

Texas has a significant number of Lefty Loons in Austin who have placed way too much of their capital investment into windmills instead of constructing more fossil fuel generating capacity. The Texas electrical grid is unstable because of the wild swings you get in how much wind power is generated on any particular day. Most really hot and cold days are associated with high pressure centers which result in days of low wind speeds just when you need the dang windmills the most. Not entirely clear. Good arguments on other side about the problems. Diversified energy looks like a good idea. www.washingtonpost.com/opinions/2022/07/21/heat-energy-crisis-would-be-worse-without-solar/Cold weather caused problems in the winter with OIL power...the article has a point. Without wind power Texas would be hurting this summer. The article isn't so much about wind power as it's about solar. And yes, I will agree solar in Texas (where I live) has been preforming exceptionally well. The Energy Reliability Council of Texas (ERCOT) has a cool website where you can track daily energy supply and demand forecasts and actual over the portion of the Texas electric grid they are responsible for (about 80% of Texas). They prominently break-out the portion of energy supplied by wind and solar. www.ercot.com/As you can see from their graphs, solar this summer has consistently supplied about 10,000 MW from about 8:00 AM to 8:00 PM. Of course it ramps-off quickly to zero before and after that. However, with peak demand occurring between 8:00 AM and midnight, other than the last 3 or 4 hours, solar matches-up pretty well. Wind on the other hand is failing miserably. Depending on what day you click-on the ERCOT website, wind will sometimes be in the 25,000+ MW range over night (when demand is low). During the day, last week when there were grid warnings for potential rolling backouts, it got down to 2,000 MW in the afternoon. Pretty difficult to depend on a source of energy that goes from 25,000 MW when demand is low (overnight) to 2,000 MW when demand is highest around 4:00 PM. In summation, at least for summer energy demands, I would be putting my capital investments into more solar and less wind. Of course in winter, when the coldest temperatures are at night, solar is worthless. You might think wind then would be the answer, but extremely cold weather normally means a high pressure center locked-in over Texas, the wind doesn't blow even at night. Best answer is a natural gas or coal fired power plant that is capable 24/7 of meeting your needs. |

|

|

|

Post by bsutrack on Jul 23, 2022 12:59:11 GMT -6

So what is causing the sudden fall in gas prices? Is there more oil available now or is there some other factor I don't know about driving the prices back down? It still hurts, though.

bsutrack may have an industry viewpoint to explain it but it sure looks like Econ 100.

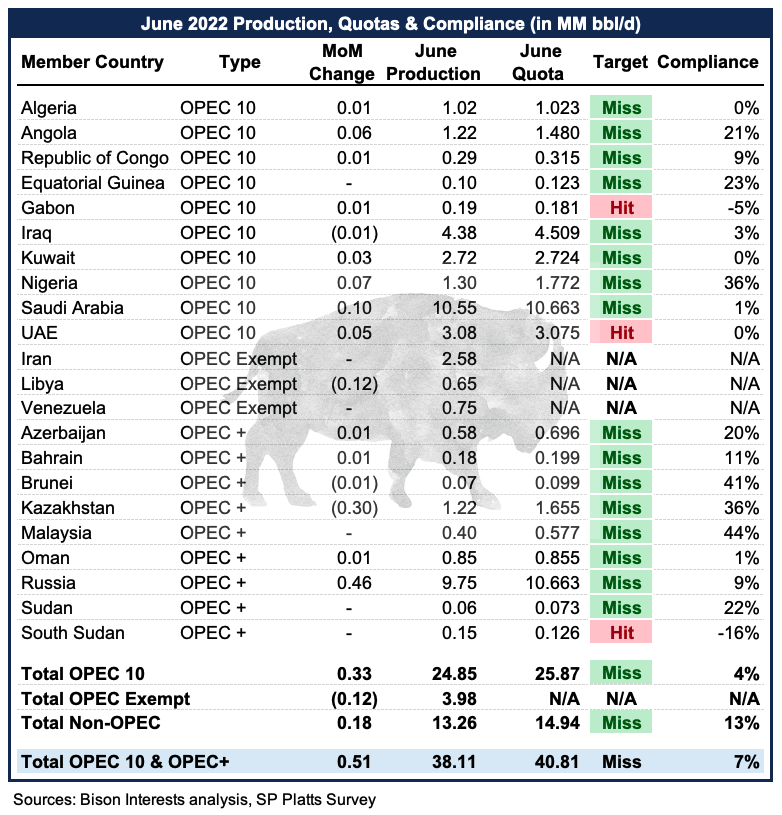

As 00 points out, the SPR oil releases (1 million BOPD) has helped keep prices in check. However, the main reason, at least in my opinion, has been the lack of success in blocking Russian oil flowing into the market.  The chart above is the June oil production for OPEC+ member countries. As you can see, Russia produced 9.75 million BOPD in June which was nearly 1/2 million BOPD more than they produced in May. In other words, the sanctions were 460,000 BOPD less successful in blocking Russian oil being sold in June compared to May. Russia's quota for June was 10.663 million BOPD, but it's unlikely they are actually capable of producing that much. Just like Saudi's quota was 10.663 and they could only produce 10.55. Russia could probably only produce around 10.250 million BOPD. In other words, the current sanctions against Russia is probably blocking about 500,000 BOPD, or about 5% of their total production. Originally the sanctions against Russia were hoped to block around 3 million BOPD. If that had happened, world oil supplies and hence prices would have indeed been much higher. As it is, sanctions are only doing 1/6 of what was hoped and gasoline prices are lower than feared. Attachments:

|

|

|

|

Post by 00hmh on Jul 23, 2022 13:44:37 GMT -6

Article cited shows the Russians have been exporting to other customers with resulting disruption of the market which had supplied those customers previously. Market seems to have now settled into a new equilibrium.

|

|

|

|

Post by bsutrack on Jul 23, 2022 15:16:39 GMT -6

Article cited shows the Russians have been exporting to other customers with resulting disruption of the market which had supplied those customers previously. Market seems to have now settled into a new equilibrium. Exactly, at first the sanctions had some impact, but then the Russians found enough customers in China, India, and other places by offering extreme discounts. Money triumphs over morality. The additional crude oil the Indians and others got from Russia at lower prices backed-out crude oil that got delivered to those countries trying to honor the sanctions. Now there are some new sanctions being rolled-out at the first of 2023 against the tanker companies that transport the oil to China and India. The hope is that will put a dent into Russian oil production. Remember most of the Russian oil delivered to Europe was transported by pipelines and much shorter routes. Lots more tankers needed now to get Russian crude to Asia. |

|

|

|

Post by chirpchirpcards on Jul 24, 2022 21:32:19 GMT -6

Article cited shows the Russians have been exporting to other customers with resulting disruption of the market which had supplied those customers previously. Market seems to have now settled into a new equilibrium. Exactly, at first the sanctions had some impact, but then the Russians found enough customers in China, India, and other places by offering extreme discounts. Money triumphs over morality. The additional crude oil the Indians and others got from Russia at lower prices backed-out crude oil that got delivered to those countries trying to honor the sanctions. Now there are some new sanctions being rolled-out at the first of 2023 against the tanker companies that transport the oil to China and India. The hope is that will put a dent into Russian oil production. Remember most of the Russian oil delivered to Europe was transported by pipelines and much shorter routes. Lots more tankers needed now to get Russian crude to Asia. So where are prices expected to go in the next 3-6 months? Will they continue their downward trend, stabilize, or rise again? |

|

|

|

Post by 00hmh on Jul 24, 2022 22:01:40 GMT -6

They will fluctuate...

Only good bet.

|

|